Monthly Foreign Exchange Review

The U.S. dollar fell sharply in late January, reaching multi-year lows against the euro and weakening versus all major currencies as the administration signaled support for a softer USD to boost U.S. production, particularly relative to China. Rates held steady at 3.5%, though a new Fed chair in May could shift expectations toward more aggressive cuts later in 2026. Despite solid GDP, consumer sentiment remains near historic lows amid weak manufacturing and labor data and elevated core inflation. Further USD weakness is expected through 2026, with increased volatility.

USD weakened considerably during the last week of January, making 3 ½ year lows against the EUR. The EUR spiked to 1.2067 on Jan 27, following a week of administration talk on USD softening. The USD fell against all major currencies. As we noted in January’s update, the administration wants a weaker USD.

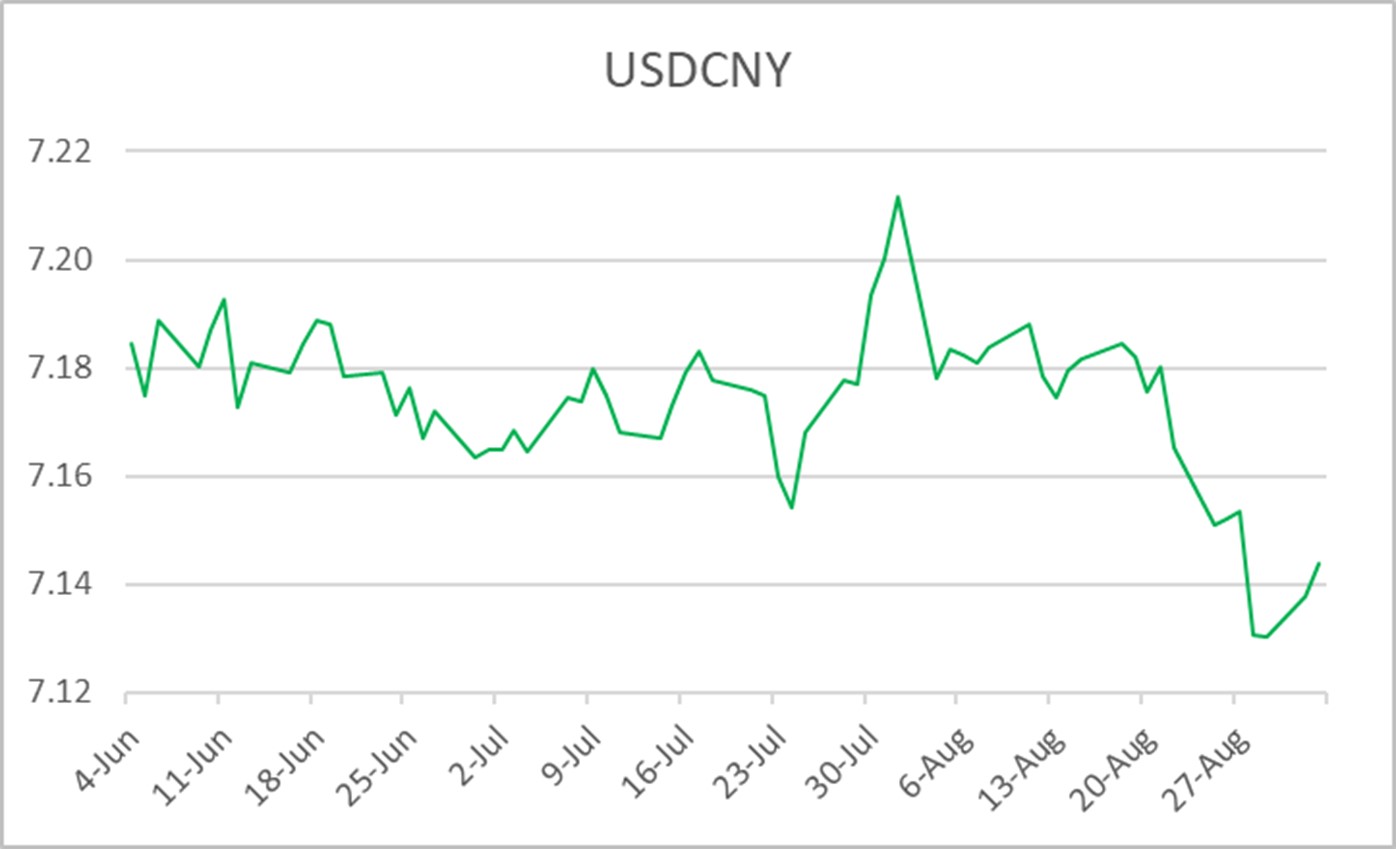

The administration has been clear about its long-term goal of strengthening U.S. production. One of the key ways to do this is through weakening the USD against other currencies and particularly the CNY. Significantly, the USD has fallen against the CNY. While the administration has been vocal about across the board tariffs, the country of most concern is China. China has long suppressed their domestic demand to gain U.S. market share in a variety of industries, so a weaker USD should provide some minor incentive to onshore production back to the USA.

Rates held steady on Jan 28 at 3.5%. The market expected this, so there was nearly zero market reaction to the rate announcement. Be warned a new fed chair will be in place as of May. There is a chance the rate outlook will change from one to two more cuts in ‘26 to a much more aggressive two to five cuts by the end of the year.

Consumer sentiment continues to be at or near record lows. This is the largest disconnect between measured economic activity and sentiment in at least the last 30 years. Sentiment is as weak as it was during the worst months of the Global financial crisis or COVID-19. Our customers feel a deep and lasting concern about the economy.

We are still catching up with current government releases from the DOGE shutdowns. GDP numbers came in stronger than expected, as lower trade deficits are a plus to GDP. Many other numbers came in either weak or negative during January, with Factory Orders, Payrolls, Durable Goods, ISM Manufacturing and Services all coming in negative. Core PPI was very strong at up 0.7% MoM. This may explain some of the negative sentiment.

We expect further USD weakness through 2026, and the risk for most of 2026 will be for sudden USD moves weaker against world currencies, followed quickly by rebounds.

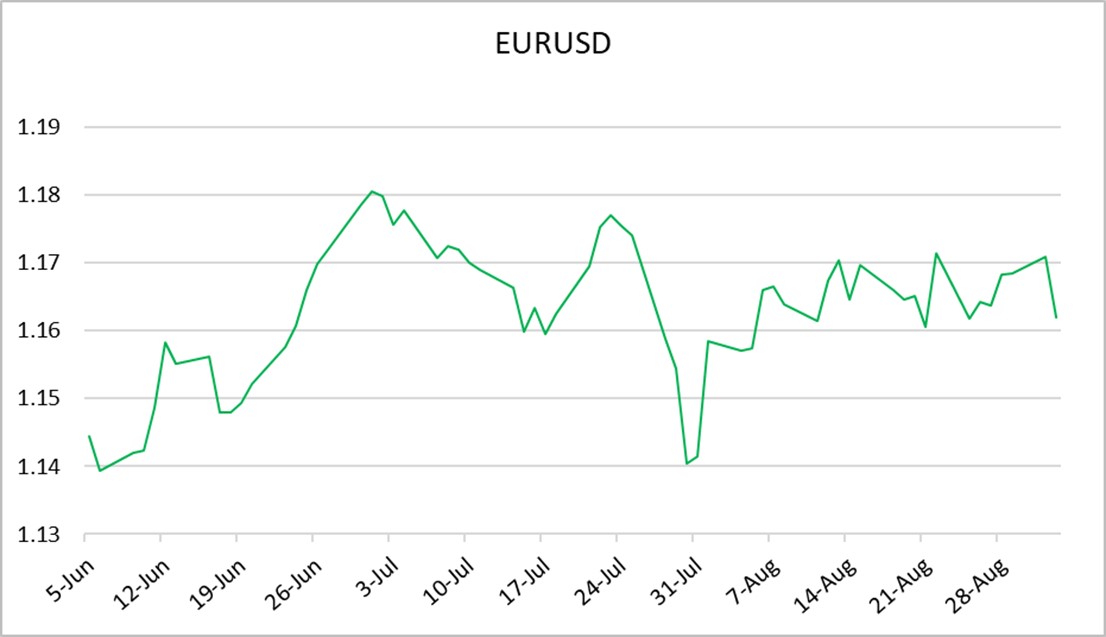

EURUSD pushed above its six-month range to 1.2081 on administration support for a weaker USD. ECB rate cut pause plus U.S. commitment to rate cuts added to the ongoing EUR trade above. As mentioned last month, the USD did break above its 1.1800 range high and hit stops above 1.2000 trading to 1.2081. The divergence between U.S. rate projections and EU pause will become increasingly important to EURUSD prices. If the USA continues a rate cut cycle while experiencing higher than expected inflation while the EU pauses with lower inflation, USD could move to test 1.2300 or above. Expect inflation news and administration talk to have outsized price impact compared to normal times in Q1-Q2.

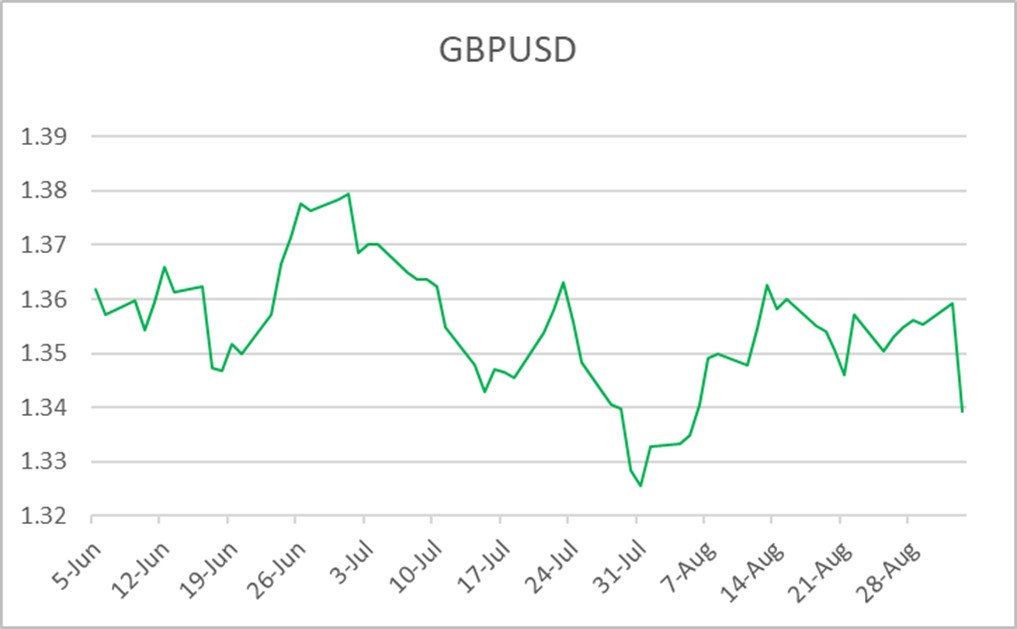

The British pound climbed to 1.3868 against the USD on USD weakness and some surprising confidence and budget numbers from the UK. UK inflation at 3.4% is higher than US and the EU, but the UK is trying to stimulate as much as possible, so rates are the same as U.S. UK consumer and business confidence are rebounding due to mild increases in GDP but from low levels. Analysts polled by Bloomberg predict a median of 1.3700 for the GBPUSD rate in Q1 2026—a big upward revision.

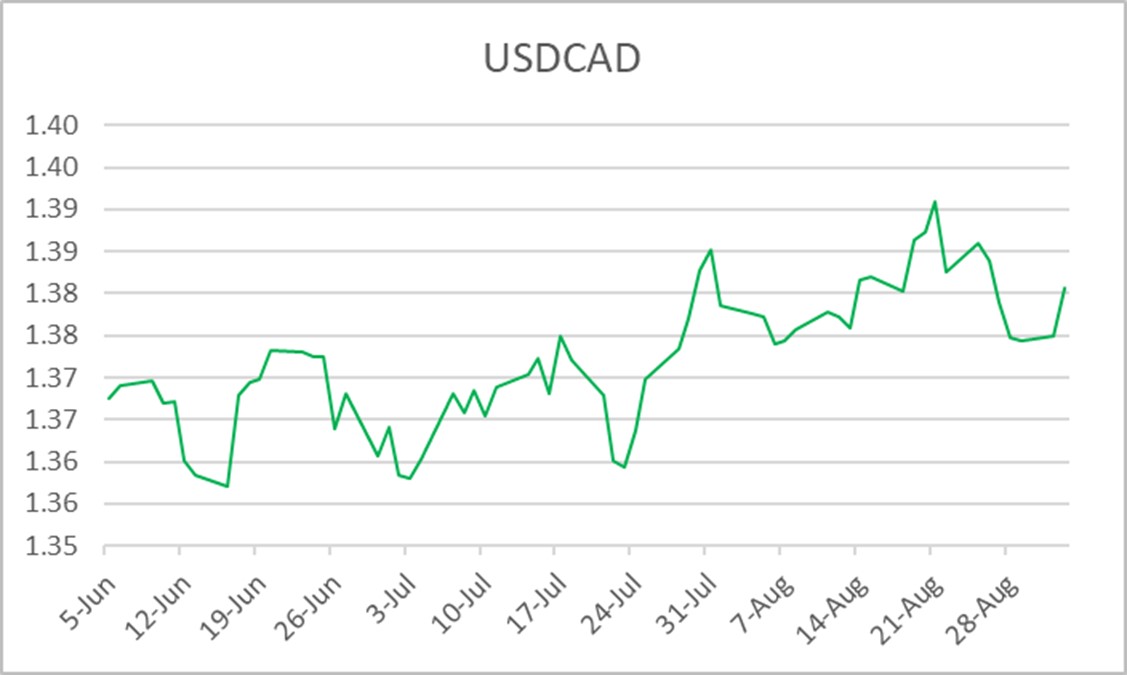

CAD strength overwhelmed the negative reaction to PM Carney’s speech about the new global structure, pushing to a low of 1.3482. Carney has since slightly walked back his comments, but he only said what many observers have been saying about economic relations with the USA and rest of the world. A minor trade announcement with China doesn’t overcome the fact that Canada’s economy is completely woven into the USA economy, and Canada remains our closest ally. Still, additional tariffs could be back on the table due to the strains. Again: expect large, unexpected movements in the USDCAD. Analysts polled by Bloomberg predict a median of 1.3500 for the USDCAD rate in Q1 2026, a large downward revision.

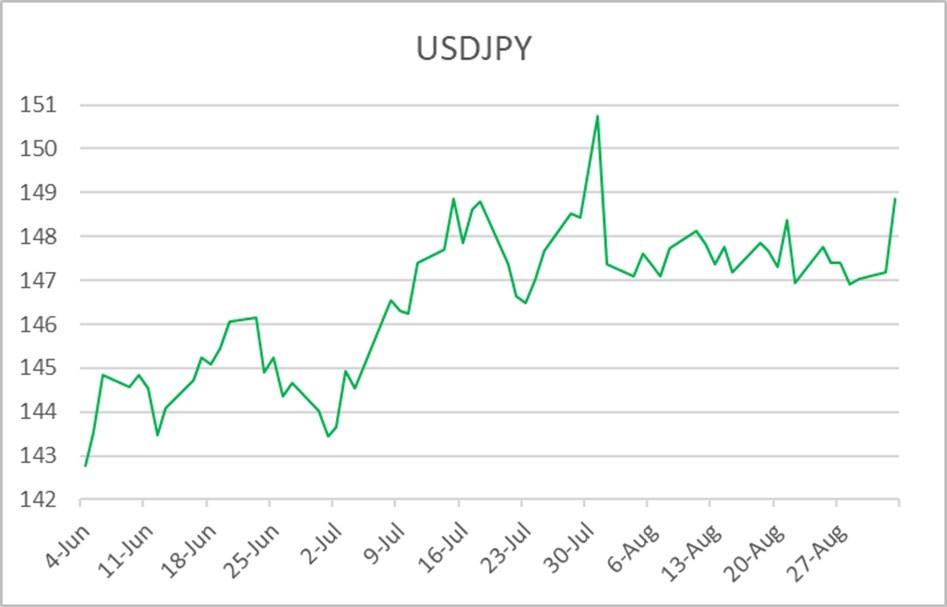

JPY found its footing against the USD after the U.S. commitment to a weaker USD. Japan is seeing serious concern about its budget deficits, as even tiny interest rates cause giant problems for their budgets. The 0.75% is low, but the debt to GDP ratio is 235%, and the current government seems to disregard any calls for fiscal restraint. Then, a snap election was called for Feb 8, just one day ago, just three months after the last election! It is seen as a referendum on the economic policy of the current government. Analysts polled by Bloomberg predict a median of 154 for the USDJPY rate in Q1 2026.

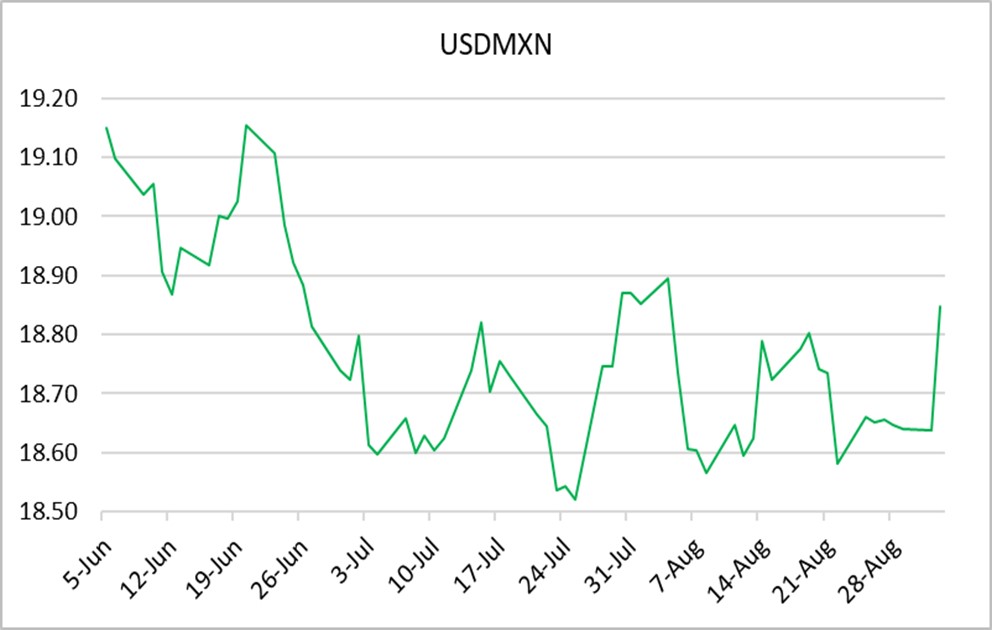

MXN continues to make new high after new high against the USD. Tariffs do not seem to be slowing appetite for Mexico trade and importantly Mexico production. Whatever the tariff rate we set on Mexico, the tariff on China will be higher, making Mexico attractive for at least the next decade Mexico. Inflation is low while rates are 7%, so borrowing USD and buying MXN is a fantastic “carry trade.” MXN has so many tailwinds pushing it stronger. Analysts polled by Bloomberg predict a median of 17.43 for the USDMXN rate in Q1 2026.

The CNY strengthened more to 6.9450 vs. the USD, which is another multi-year year high against the USD. China is positioning itself worldwide as the reliable trading partner, but it’s well-known that China is interested in market share first and foremost. The world comparison, at the moment, is this: China will do anything for market share, so be careful, but can we trust the USA to not change the rules mid-game? This recent infatuation with China will fade, but the change in the U.S. approach will not—expect the US to force the CNY stronger through 2026. Analysts polled by Bloomberg predict a median of 18.41 for the USDMXN rate in Q1 2026.

Associated Bank can transact foreign exchanges in more than 100 currencies. Companies interested in learning more about making payments in foreign currencies or in hedging currency exposures should contact their Associated Bank Relationship Banker or the bank’s Corporate Foreign Exchange Department at 866-524-8836 or email fxcapmarkets@associatedbank.com.

All rates shown are indications only and subject to change. Foreign exchange contracts are subject to foreign currency exchange risk and are NOT deposits or obligations of, insured or guaranteed by Associated Bank, N.A. or any bank or affiliate, are NOT insured by the FDIC or any agency of the United States, and involve INVESTMENT RISK, including POSSIBLE LOSS OF VALUE. This material is provided to you for informational purposes only; and any use for other than informational purposes is disclaimed. It is a summary and does not purport to set forth all applicable terms or issues. It is not intended as an offer or solicitation for the purchase or sale of any financial product and is not a commitment by Associated Banc-Corp, its subsidiaries or affiliates, as to the availability of any such product at any time. The information herein is not intended to constitute legal, tax, accounting, or investment advice, and you should consult your own advisors as to such matters and the suitability of any transaction. We make no representations as to such matters or any other effects of any transaction. In no event shall we be liable for any use of, for any decision made or action taken in reliance upon, or for any inaccuracies or errors in, or omissions from, the information herein. The views expressed here are solely those of the author and do not reflect the views of Associated Banc-Corp, its subsidiaries or affiliates.