Monthly Interest Rate Update

Kevin Warsh has been nominated as the next Federal Reserve Chair. Despite his hawkish background, he now supports rate cuts tied to AI-driven productivity gains, even as job growth slows and the labor market remains fragile.

Markets have reacted calmly. Interest rates and Treasury yields have changed little; the yield curve continues to steepen and expectations for gradual rate cuts remain largely intact despite broader political and market volatility.

Kevin Warsh was announced as the nominee to head the Federal Reserve on January 30, to replace Jerome Powell when his term expires in May. Warsh, a former Fed Governor during the 2008 financial crisis, has been a longstanding monetary hawk, arguing against the growth in the Fed’s balance sheet and favoring tighter monetary policy even at times of high unemployment. More recently, he has switched gears and come out in support of faster and deeper cuts in the Fed funds rate, based on the premise that AI-fueled productivity improvements will allow faster economic growth without igniting inflation.

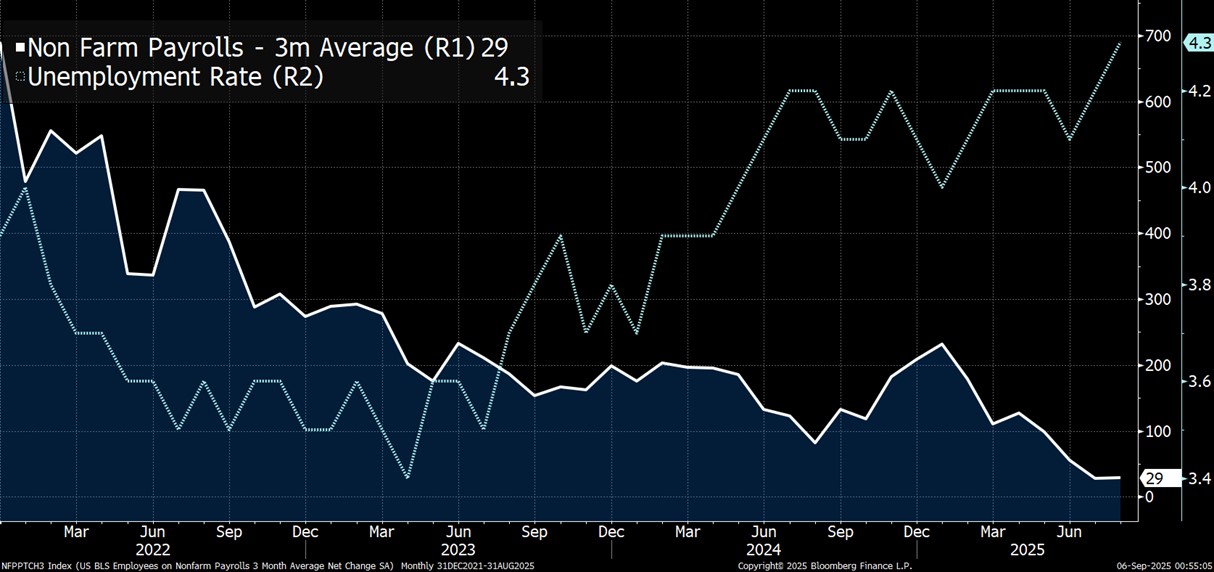

The downside of Warsh’s expected productivity gains is a weak labor market. Nonfarm productivity (hourly output per employee) rose 4.9% in the third quarter of 2025, in part due to increased use of automation and AI. With fewer workers needed, the U.S. economy only created 371,000 jobs last year, the lowest since 2020, well below the 20-year annual average of 1.2 million. Meanwhile, the unemployment rate ticked downward slightly to 4.4%. Overall, the labor market has been in stasis as employers scale back hiring and workers hang onto their jobs. The Job Openings and Labor Turnover Survey (“JOLTS”) shows a continued downdraft in job openings, along with low levels of both layoffs and voluntary quits. There has, however, been an uptick in 2026 layoff announcements, so the job market remains vulnerable.

Interest rates held steady in the days after the Warsh announcement thanks to his experience and reputation as a hawk. There was some near-term rate volatility in the midst of broader market turmoil, including a plunge in Bitcoin, surges in gold and silver, and a declining equity market. Treasury yields are down only two to three basis points from the end of January and remain slightly above year-end levels.

Futures markets, which have been pricing in a 50-basis point reduction in the Fed funds rate by the end of 2026, have shifted only slightly downward. There is now a 43% chance of three or more quarter-point cuts priced in this year, up from 36% a week ago.

The yield curve continues to steepen, and inflation expectations rise as concerns over Fed independence persist. The spread between two- and 10-year Treasuries reached 72 bp, and has now risen 178 bp since 2023, when it was inverted by 106 bp. This trend is likely to persist as the Fed cuts short-term rates and long-term rates hold steady to higher. The five-year TIPS breakeven rate, which prices in the market’s expectation of inflation, has moved up a quarter-point since year-end, currently standing at a somewhat elevated 2.51%.

Despite political and economic turmoil, the interest rate market looks surprisingly calm for now. Minnesota protests, conflicts with allies over tariffs and Greenland, government shutdowns, upcoming mid-terms and a new Fed Chair, among other developments, have fueled volatility across equity, commodities and currency markets. Meanwhile, interest rates remain stable, with a normalizing Treasury curve and yields still below their 20-year averages. Rates volatility, as measured by the MOVE index, remains muted.

As a result, we have seen steady activity in the swap market as clients use this opportunity to take risk off the table. With the yield curve likely to steepen further and forward premiums still low, it makes sense to review upcoming debt maturities and funding needs, while maintaining a disciplined approach to managing your interest rate risk.

Key Statistics: Interest Rates, Unemployment and Inflation

| Year-end 2022 | Year-end 2023 | Year-end 2024 | Year-end 2025 | January 30, 2025 | |

|---|---|---|---|---|---|

| 10-yr Treasury yield | 3.87% | 3.88% | 4.57% | 4.17% | 4.24% |

| 2-yr Treasury yield | 4.43% | 4.25% | 4.24% | 3.47% | 3.52% |

| Spread | -0.56% | -0.37% | 0.33% | 0.70% | 0.72% |

| Fed Funds Target (mid) | 4.375% | 5.375% | 4.375% | 3.625% | 3.625% |

| CME Term SOFR 1-mo | 4.36% | 5.35% | 4.33% | 3.69% | 3.67% |

| CPI (y/y change) | 6.5% | 3.1% | 2.7% | 2.7% | 2.6% |

| Core PCE (monthly) | 4.7% | 3.16% | 2.81% | 2.83% | 2.79% |

| 5-yr TIPS (market breakeven) | 2.38% | 2.15% | 2.39% | 2.27% | 2.50% |

| U-3 Unemployment | 3.5% | 3.7% | 4.1% | 4.4% | 4.4% |

| Real avg weekly earnings | -3.1% | 0.5% | 1.0% | 1.1% | 1.1% |

| Annual change in NFP jobs | +4,503,000 | +2,560,000 | +1,450,000 | +371,000 | +371,000 |

Benchmark Treasury Trends

Source: Bloomberg Finance LP

- 10-year U.S. Treasury yields have drifted upward since October, even as two-year yields remain flat, steepening the Treasury curve to a four-year high.

- Corporate bond spreads (not pictured) remain historically tight.

Federal Reserve Resumes Rate Cuts in October, Pauses in January

Source: Bloomberg Finance LP

U.S. Dollar Weakens As Haven Status Slips, Gold Surges

Source: Bloomberg Finance LP

Associated Bank offers a wide range of instruments for hedging interest rate, commodity and foreign currency risk, including foreign exchange in more than 75 currencies. Companies interested in learning more about these instruments should contact their Associated Bank Relationship Banker or the bank’s Capital Markets Department at 866-524-8836.

All rates shown are indications only and subject to change.

This material is provided to you for informational purposes only; and any use for other than informational purposes is disclaimed. It is a summary and does not purport to set forth all applicable terms or issues. It is not intended as an offer or solicitation for the purchase or sale of any financial product and is not a commitment by Associated Banc-Corp, its subsidiaries or affiliates, as to the availability of any such product at any time. The information herein is not intended to constitute legal, tax, accounting, or investment advice, and you should consult your own advisors as to such matters and the suitability of any transaction. We make no representations as to such matters or any other effects of any transaction. In no event shall we be liable for any use of, for any decision made or action taken in reliance upon, or for any inaccuracies or errors in, or omissions from, the information herein. The views expressed here are solely those of the author and do not reflect the views of Associated Banc-Corp, its subsidiaries or affiliates.