Investing in volatile markets

Learn how to manage market volatility by sticking to a disciplined, long-term investment strategy and avoiding emotional reactions. Stay on course for financial success.

An environment like 2025 so far reinforces the importance for investors to have a plan, understand their cash needs and risk tolerance, and maintain a focus on their goals. Swings in returns and market values are inherently part of investing in any asset class and benefiting from the long-term returns that they have historically delivered. Approaches that include diversification, disciplined rebalancing and patience can help investors.

Financial market volatility and the economic and geopolitical factors that drive it are not new. Over the past 45 years we’ve experienced The Great Financial Crisis, the “Tech Wreck” of 2000, the COVID-19 Pandemic and more. Each time, a sense that “this time is different” and a recovery isn’t probable, or even possible, washes over investors. Yet, each time, the markets have eventually recovered and made new highs, rewarding those who remained patient and disciplined.

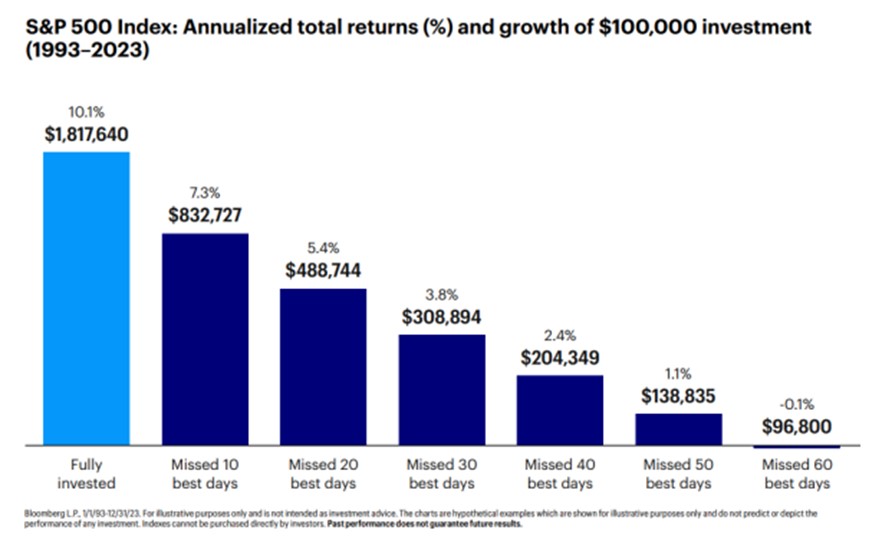

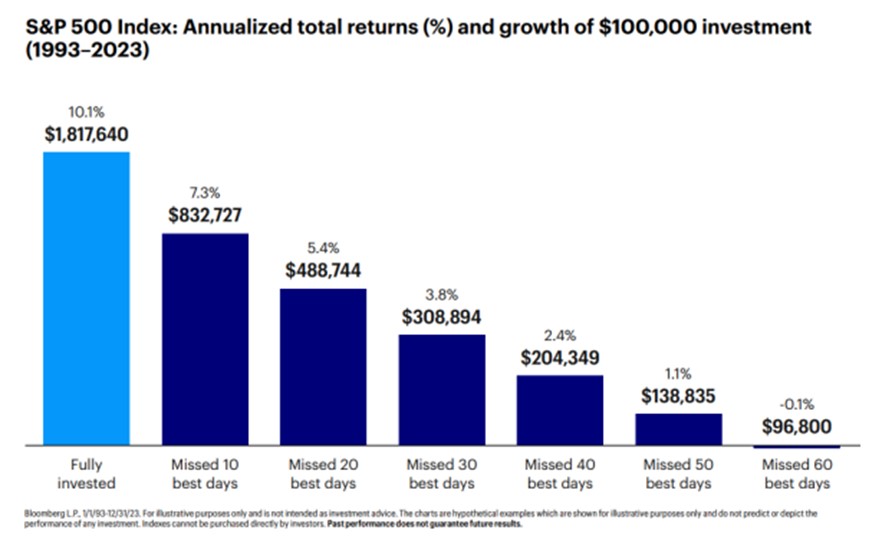

Investors should remember that trying to time the market and avoid the worst trading days, often fails to add any value. The below chart shows S&P 500 annualized total returns between 1993 and 2023. Missing just the 10 best trading days lowers the annual total return from 10% to 7.3% over that 30-year period. Those 10 best trading days happened in 2008, 2009 and 2020 or during the 2008 Financial Crisis and 2020 COVID-19 pandemic.

What investors can do

The current turbulence is prompting many emotions among investors. The key lies in how one responds. We believe the following principles can help investors navigate through markets of all kinds:

- Maintain a long-term perspective – If the need for invested assets is years or even decades away, this volatility likely is just another "sawtooth" in the graph of assets over time. If contributions are still being made to the portfolio, this may be viewed as an opportunity to buy low.

- Focus on quality – In challenging periods, quality assets tend to hold up better, preserving capital. Companies with strong balance sheets, solid business models and capable management are positioned to weather storms and continue to grow when the economic environment improves.

- Diversify – Portfolio exposure to different asset classes and subclasses, industry sectors and geographies helps to manage risk. When one component of the portfolio is declining, others may be holding their value or even moving up modestly, helping to mitigate the swings in the overall portfolio.

- Rebalance in a disciplined manner – Understanding one’s risk tolerance and the long-term allocation that matches it allows an investor to turn the volatility to an advantage by buying the losers and selling the winners. Having belief in a long-term plan, the quality of assets and the proper diversification of the portfolio can provide the confidence to buy investments at opportune times and improve the future risk/reward profile of the portfolio. Rebalancing in this way can also fulfill the very human need to do SOMETHING in periods of change.

- Understand and manage cash needs – Knowing what one needs to support anticipated spending and/or just being comfortable can help to eliminate the urge to sell long-term investments. For a retiree, knowing the next 12 months of living expenses are covered by reliable sources of income and/or low risk reserves likely gives markets time to recover. For someone still employed, an appropriate emergency fund can provide peace of mind that unexpected events won’t derail the long-term plan.

While volatility may remain elevated for the foreseeable future, indications of underlying strength and stability provide the foundation on which to build a long-term outlook. The infrastructure of the markets has functioned extremely well; through historic trading volumes and rapid price moves, trading has functioned in an orderly manner with no disruptions or dislocations. The US economy entered this period of primarily political uncertainty on solid footing with solid labor markets and resilient corporate profitability. And, the Federal Reserve has the flexibility to reduce short-term interest rates in support of the economy if necessary.

Having a comprehensive, up-to-date financial plan can be essential to both understanding needs and "sticking to the plan". Engaging with a trusted, experienced team or advisor may help investors stay with these principles in trying times.

This market commentary is for informational purposes only. It discusses general market activity, industry or sector trends, or other broad-based economic, market, or political conditions. The views, opinions, estimates, and projections are as of the date of publication and are subject to change without prior notice. Readers should not consider it analysis upon which to make investment decisions or recommendations of strategies or particular securities. Instead, they should consult with their investment professional regarding their particular circumstances.

Contents herein have been compiled or derived in part from sources believed to be reliable, but we do not guarantee its accuracy, completeness, or fairness. We have relied upon and assumed without independent

verification, the accuracy and completeness of all information available from public sources.There can be no assurance the forecasts will be achieved. Past performance does not guarantee future results, which may vary.

The information provided represents the opinion of Associated Bank and its affiliates. It is not intended to be a forecast of future events or guarantee of future results. It is not intended to provide specific investment advice and should not be construed as an offering of securities or recommendation to invest. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Not a representation or solicitation or an offer to sell/buy any security. Investors should consult with their investment professional for advice concerning their particular situation.

Investment, Securities and Insurance Products:

NOT

FDIC INSUREDNOT BANK

GUARANTEEDMAY

LOSE VALUENOT INSURED BY ANY

FEDERAL AGENCYNOT A

DEPOSITAssociated Bank and Associated Bank Private Wealth are marketing names AB-C uses for products and services offered by its affiliates. Securities and investment advisory services are offered by Associated Investment Services, Inc. (AIS), member FINRA/SIPC; insurance products are offered by licensed agents of AIS; deposit and loan products and services are offered through Associated Bank, N.A. (ABNA); investment management, fiduciary, administrative and planning services are offered through Associated Trust Company, N.A. (ATC); and Kellogg Asset Management, LLC® (KAM) provides investment management services to AB-C affiliates. AIS, ABNA, ATC, and KAM are all direct or indirect, wholly-owned subsidiaries of AB-C. AB-C and its affiliates do not provide tax, legal or accounting advice. Please consult with your advisors regarding your individual situation. (1024)