Quarterly Economic and Market Review

- US Economy Marches On—Government shutdown and tariff shock couldn’t stop the US economy from above-trend growth.

- Great Year for Bonds and Stocks—Quiet yet volatile finish capped off a year that produced upper single-digit bond returns and a third consecutive year of double-digit returns for the S&P 500.

- Uncertainty at Federal Reserve—With Chairman Jerome Powell’s term ending in the next several months and economic data mixed, the Federal Reserve appears unusually split on the direction of monetary policy.

Growth surges

Despite an extraordinary backdrop marked by a record 44-day government shutdown, prolonged tariff uncertainty and the lingering pressure of elevated interest rates, the U.S. economy extended its expansion in 2025. Looking back at the third quarter, real GDP grew at a robust 4.3% annualized pace, significantly exceeding investor expectations. This resilience surprised many observers, particularly given weakening consumer sentiment and stagnant employment growth.

The final quarter of the year revealed several important supports for economic growth, including strong business investment, healthy export activity and resilient consumer and government spending. Rather than signaling deterioration, the closing months of the year reflected a moderation. Growth slowed from earlier peaks but remained firmly positive.

Continued wage growth, combined with a positive “wealth effect,” allowed consumers to sustain spending through the quarter and into the holiday season. Rising equity and housing values boosted household balance sheets, reinforcing consumer confidence even as survey-based sentiment remained subdued. Business activity followed a similar pattern. Large-scale capital investments—specifically in data centers, automation and efficiency-enhancing AI projects—provided a meaningful lift to economic output.

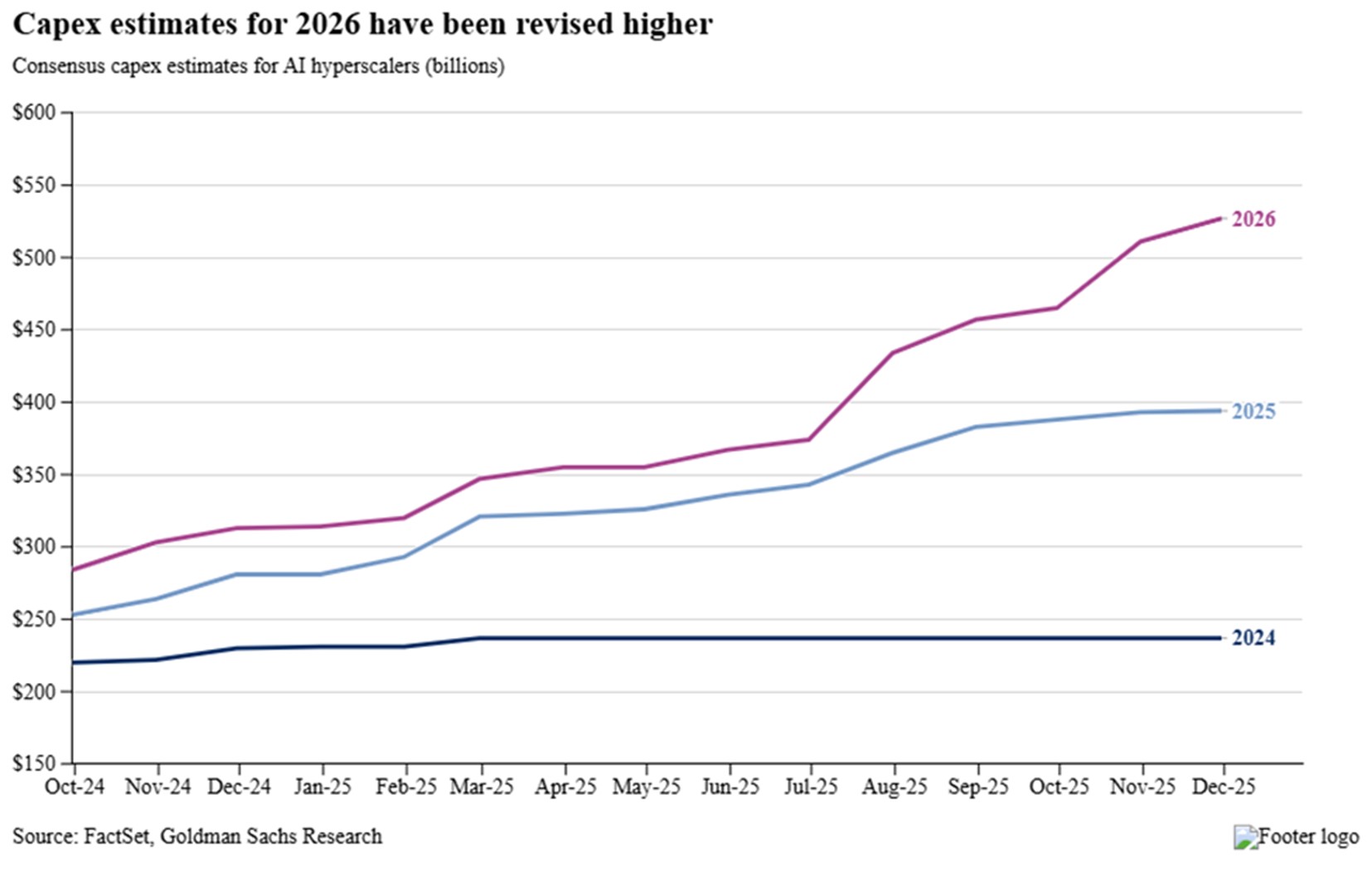

Importantly, these capital expenditures show no signs of slowing; current projections call for approximately $527 billion in AI-related infrastructure investment in 2026 alone, underscoring the durability of this industrial shift.

Government spending also played a meaningful role. While portions of federal activity were paused during the shutdown, many critical outlays continued. Entitlement programs such as Medicare and SNAP largely remained in place and national security spending was unaffected. Furthermore, state and local governments maintained investments in public infrastructure and essential services, providing a floor for aggregate demand.

Even with the drag from political friction, the Federal Reserve Bank of Atlanta’s GDPNow, projected real annualized growth of approximately 3.0% for the final quarter of 2025—capping another year of above-trend performance.

Market evens out

The final months of 2025 were marked by modest returns and intermittent volatility. Despite these headwinds, U.S. equities finished the year at record highs, once again led by large-cap technology and AI-adjacent firms. The S&P 500 gained 16.5% for the year, while the more technology-heavy NASDAQ advanced 20.3%, marking a third consecutive year of double-digit equity returns.

While market leadership remained narrow for much of the year, signs of improving breadth emerged late in the fourth quarter. In November, information technology stocks briefly relinquished their lead after several high-profile AI companies failed to meet elevated earnings expectations. Investor scrutiny intensified around “circular” AI transactions—arrangements where large technology firms finance AI companies that that then use those funds to purchase cloud services or semiconductors. These “round-trip” structures have raised questions regarding earnings quality and sustainability of tech earnings.

Small- and mid-cap stocks followed a more volatile path. Early optimism surrounding the One Big Beautiful Bill Act (OBBBA) – specifically its provision for bonus depreciation and factory expensing- supported a brief rally in smaller companies. However, this momentum faded as the quarter progressed. November marked the strongest period for smaller firms, outperforming large-cap companies by more than 2%. Notably, the rally was driven primarily by unprofitable companies, a sign investors were seeking speculative alternatives to express bullish views on AI. As we enter 2026, the durability of market breadth will be a key signal for the health of the broader bull market.

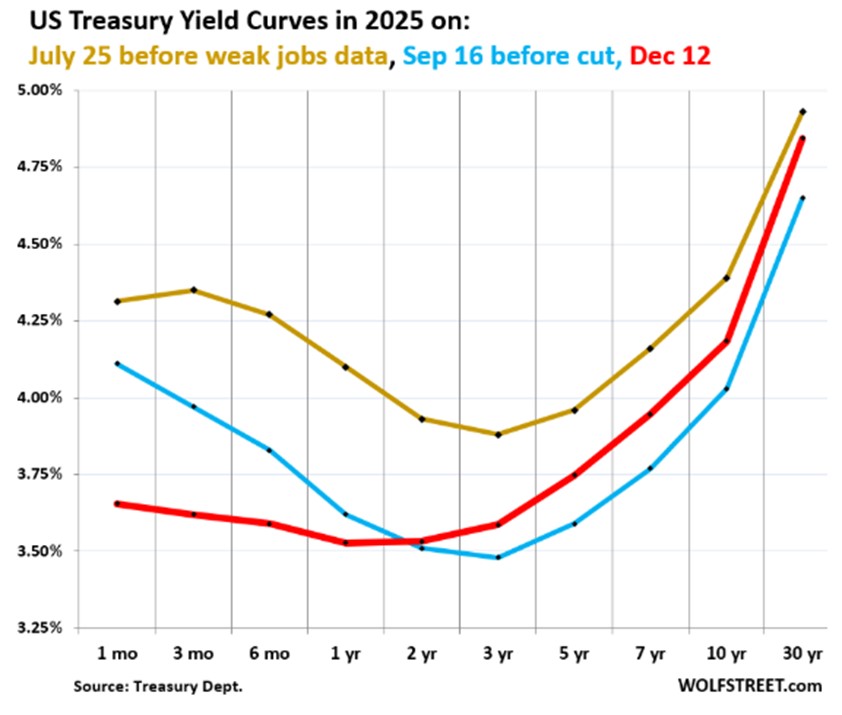

Normalization of the rate curve

The fourth quarter capped a year of exceptional returns for fixed income markets. Short-term government bonds returned 5.17%, the Bloomberg Barclays Aggregate Index gained 6.97% and high-yield corporate bonds returned 8.62%. This performance was driven by a combination of elevated starting yields and a downward shift in the yield curve following three rate cuts in the second half of the year.

At the beginning of the year, the Treasury curve was notably flat with yields across all maturities clustered tightly between 4.17% and 4.57%. This shape reflected restrictive short-term policy rates, muted long-term inflation expectations and an expectation that Fed policy would ease.

Today, the curve is beginning to “normalize.” As short-term rates decline and long-term rates stabilize, the spread is widening modestly. With money market yields down nearly one percentage point over the past year, investors holding large cash allocations may wish to reassess the appropriate balance between yield, duration and risk.

Deep dive: Dissent at the Fed

The Federal Reserve, the government entity responsible for U.S. monetary policy, is facing significant internal and external pressure entering 2026. While designed as a non-partisan body, political pressure has been a recurring feature of Federal Reserve governance. In recent years, the Fed has faced open criticism from the White House regarding the pace of rate cuts. With Powell’s term as Chair set to expire in May, leadership of the Board could shift in a more accommodative direction. While the Chair’s vote carries no more formal weight than others, the role commands significant influence over policy direction and internal consensus.

A case in point is Paul Volcker’s 1979 appointment at a time when inflation had been entrenched for years. Within months, the Fed fundamentally altered its policy framework and initiated a series of aggressive rate hikes. While today’s economic climate does not suggest a similar upheaval, the Chair’s role can significantly reshape policy.

The Fed’s task has been further complicated by conflicting economic signals. The labor market has shown little net growth over the past six months, while inflation remains near 3%, above the Fed’s long-term target. This tension led to the largest number of dissenting votes in more than 30 years at the July meeting. Subsequent meetings in November and December featured a rare dissent on both sides—calls for tighter and looser policy.

As markets attempt to price the future path of interest rates, this economic and politically driven uncertainty suggests that volatility around monetary policy is unlikely to subside.

Sources:

US Treasury Yield Curve in 2025” - https://wolfstreet.com/2025/12/15/treasury-yield-curve-steepens-sharply-yields-from-2-years-to-30-years-have-risen-as-the-fed-cut-three-times-this-year/

Capex Estimates for 2026 Have Been Revised Higher” - https://www.goldmansachs.com/insights/articles/why-ai-companies-may-invest-more-than-500-billion-in-2026

Investment, Securities and Insurance Products:

NOT

FDIC INSUREDNOT BANK

GUARANTEEDMAY

LOSE VALUENOT INSURED BY ANY

FEDERAL AGENCYNOT A

DEPOSITAssociated Bank and Associated Bank Private Wealth are marketing names AB-C uses for products and services offered by its affiliates. Securities and investment advisory services are offered by Associated Investment Services, Inc. (AIS), member FINRA/SIPC; insurance products are offered by licensed agents of AIS; deposit and loan products and services are offered through Associated Bank, N.A. (ABNA); investment management, fiduciary, administrative and planning services are offered through Associated Trust Company, N.A. (ATC); and Kellogg Asset Management, LLC® (KAM) provides investment management services to AB-C affiliates. AIS, ABNA, ATC, and KAM are all direct or indirect, wholly-owned subsidiaries of AB-C. AB-C and its affiliates do not provide tax, legal or accounting advice. Please consult with your advisors regarding your individual situation. (1024)

Readers should not consider this update of the economic and investment environment as analysis upon which to make investment decisions or recommendations of strategies or particular securities. Past performance is no guarantee of future results. (1414)

All trademarks, service marks and trade names referenced in this material are the property of their respective owners.