Understanding Personal Checking and Your Finances (Checking Account Basics)

-

Checking accounts offer easy access to your money for everyday spending, including bills, groceries, and online payments.

-

They typically have low or no interest, making them best for short-term use—not long-term savings.

-

There are multiple types of checking accounts (e.g., traditional, student, business) designed to match different financial needs.

-

Understanding and avoiding common fees—like overdraft or ATM charges—can help you manage your account more efficiently.

If you’ve ever wondered where to safely park your paycheck or how to make paying bills simpler, the answer likely starts with a checking account.

This essential financial tool makes it easy to access your money, cover daily expenses, and stay in control of your cash flow.

But not all checking accounts are created equal.

In this guide, we’ll break down what a checking account is, how it works, how it compares to a savings account, and how to choose the right one for your needs—whether you're just getting started or rethinking your current setup.

What is a checking account?

A checking account is a bank account designed for everyday use that makes it easy to deposit, withdraw and transfer money. Like savings accounts, checking accounts keep your money safe until you need it.

However, savings accounts may come with restrictions on how many deposits or withdrawals you can make in any given month, checking accounts generally have no restrictions on how frequently you can use them.

The trade-off for this flexibility is that checking accounts may have much lower interest rates than comparable savings accounts and certificates of deposit (CDs). For this reason, it’s generally smart to use a checking account for your immediate needs such as:

- Rent

- Groceries

- Paying down your credit card

You can then use a savings account for any long-term financial goals, such as saving up for a larger purchase or building out an emergency fund.

How do I use a checking account?

Different accounts have different features that can affect how you manage your finances. For example, if you want your money to grow over time—and don’t need it in the near future—you may want to put it in an investment or money market savings account so it can grow in value over time.

Checking accounts, on the other hand, are usually used to save up for short-term expenses like rent or next month’s groceries.

For example, you could:

- Have your employer direct deposit your paycheck into your checking account to gain immediate access to your money.

- Write checks to other people or entities to easily transfer money from your account to someone else’s.

- Make purchases with the debit card attached to your checking account.

- Make withdrawals and deposits at your local branch or any ATM.

- Use your bank’s online services to pay bills, set up recurring payments or transfer funds from one account to another.

Keep in mind that checking accounts may have low interest rates, meaning that you generally wouldn’t store large amounts of money in a checking account. Instead, a good general guideline is to try to keep around one to two months’ worth of living expenses in your checking account, plus a small buffer for any unexpected expenses.

If you have more than this amount in your checking account, consider opening a savings or investment account instead so your money can gain more interest and grow over time.

Types of checking accounts

Understanding the different types of checking accounts can help you choose the one that best fits your financial needs. Below are the most common types and their features:

- Traditional Checking Accounts

- Features: Basic banking services such as writing checks, debit card access, and online banking. Often have low or no monthly fees.

- Best for: Everyday banking needs.

- Interest-Bearing Checking Accounts

- Features: Earn interest on your balance while enjoying the conveniences of a traditional account. These accounts may require higher minimum deposits.

- Best for: Individuals who maintain higher balances to offset potential fees.

- Business Checking Accounts

- Features: Designed for small business owners, offering higher transaction limits, merchant services, and tools to manage business finances separately from personal accounts.

- Best for: Entrepreneurs and small business owners.

- Joint Checking Accounts

- Features: Shared access for two or more people, making it ideal for managing shared expenses like household bills.

- Best for: Couples, roommates, or family members managing joint finances.

By exploring these options, you can select a checking account that aligns with your financial goals and lifestyle.

Fees and costs associated with checking accounts

Understanding the fees associated with checking accounts can help you manage your finances more effectively and avoid unnecessary costs.

Here are some common checking account fees:

- Monthly Maintenance Fees:

- How to Avoid: Many banks waive these fees if you meet certain requirements, such as maintaining a minimum balance (typically $500-$1,500) or setting up direct deposits.

- Overdraft Fees:

- How to Avoid: Consider linking your savings account to your checking account by enrolling in overdraft protection programs to prevent these charges.

- ATM Fees:

- How to Avoid: Look for banks that offer fee-free ATM access or reimburse out-of-network ATM fees.

- Minimum Balance Fees:

- How to Avoid: Choose accounts with no minimum balance requirements or ensure you maintain the required balance.

- Foreign Transaction Fees:

- How to Avoid: Use accounts or credit cards that waive foreign transaction fees when traveling abroad.

By understanding these fees and how to avoid them, you can choose a checking account that aligns with your financial habits and minimizes costs.

How to choose a checking account that’s right for you

People use money in different ways, and there’s no single “best” checking account that’s right for everyone. For this reason, it’s smart to compare the benefits of different checking accounts to find the one that’s right for you.

As you’re looking at the different checking accounts that banks have to offer, there are a few things to keep in mind:

- Does the account have a minimum opening deposit? Some banks and account types require a small deposit upfront to let you open an account.

- Does the bank charge any fees related to the account? Some banks charge monthly maintenance fees and administrative fees, while others charge fees to use ATMs and other services.

- Does the checking account pay any interest? Banks will typically offer a small interest rate each month depending on how much money you have in your checking account, and while checking accounts normally earn less interest than savings accounts, it’s certainly a factor worth exploring.

- Is the account FDIC-insured? If so, then your account is protected for up to $250,000. This means that the account is backed by the U.S. government and your money will be protected in the event of a financial crisis (with the most recent example being the 2008 financial crisis).

- Does the bank have easy-to-use digital banking options? You can perform many common banking tasks quickly and easily on your computer or phone, so having a convenient and secure way to manage your checking account is an important aspect to consider.

The biggest factor, however, is whether the checking account—and the bank—works for you.

Remember, you’ll likely log in to your checking account at least a few times every month to pay bills and check your balance. Since you’ll be using the account regularly, you’ll want to work with a trusted banking partner that can help you manage your finances in a way that fits your lifestyle.

For this reason, it’s smart to choose a bank that’s active in your local area so you can easily access any resources you’ll need from people who live and work in your community.

Checking vs. savings accounts

The main difference between checking and savings accounts is that checking accounts are designed for frequent, everyday transactions, while savings accounts are meant for storing money and earning interest over time.

While checking and savings accounts may seem similar at first glance, as noted above, they are very different in practice. To quickly summarize the key differences:

|

Feature | Checking Account | Savings Account |

|---|---|---|

| Purpose | Daily spending | Long-term savings |

| Access | Debit cards, checks, unlimited transactions | May have limited withdrawals, no debit cards |

| Interest | Minimal or none | Higher interest rates, Associated right now offers 2.00% APY at the most for savings |

| Best For | Bills, groceries, everyday expenses |

Emergency funds, vacations, large purchases |

Checking Accounts — Checking accounts are ideal for frequent transactions, such as paying bills, buying groceries, or withdrawing cash. They often come with tools like mobile banking, direct deposit, and debit cards. However, they typically offer little to no interest and may include fees like overdraft charges.

Savings Accounts — Savings accounts are designed to help you grow your money over time. They offer higher interest rates, with some high-yield accounts providing up to 5% APY. However, they may have restrictions on the number of withdrawals you can make each month.

Pro Tip: To optimize your finances, consider using both accounts. Use a checking account for daily needs and recurring expenses, and a savings account to build reserves, earn interest, and achieve long-term financial goals.

Using a Checking Account to Improve Your Finances

Opening a checking account is a vital step toward achieving financial success and effectively managing your money. Checking accounts offer a variety of benefits that can help you take control of your finances and work toward a secure financial future.

Benefits of a checking account:

- Convenience: Enjoy easy access to your funds with multiple ways to deposit and withdraw money, including ATMs, debit cards, online banking, and mobile apps. These tools make daily transactions seamless and efficient.

- Financial Control: Monitor your spending and manage your budget with tools like real-time balance updates, automated expense categorization, and spending alerts to help you stay on top of your finances.

- Security: Keep your money safe in an FDIC-insured account, which protects your funds up to $250,000. Additionally, using a checking account reduces the risks associated with carrying physical cash.

- Automation: Simplify your financial life by setting up automated bill payments to avoid late fees and scheduling recurring transfers to savings or investment accounts to support your financial goals.

- Support from Local Experts: Benefit from personalized service and guidance from local banking professionals who can help you manage your finances effectively and provide tailored advice to meet your needs.

By leveraging these benefits, you can take control of your finances, simplify your money management, and build a strong foundation for your financial future.

Ready to simplify your money management?

Whether you're opening your first account or looking to upgrade your current setup, the right checking account can make all the difference. At Associated Bank, we offer a range of personal and business checking options designed to fit your lifestyle—with easy digital tools and local support to back you up.

Schedule a quick chat with a local banker today and take the first step toward smarter financial control.

Checking account FAQ

Organizing your finances can be difficult at first, and you may have some questions about checking accounts and how you can use them to improve your financial situation. Below, we’ve provided some quick answers to the most common questions we get about checking accounts.

If you have any additional questions—or if you’d like to chat about your options with someone in person—don’t hesitate to reach out to your local Associated Bank branch.

What do I need to open a checking account?

Banks have a few basic requirements for opening a checking account, such as being 18 years or older and a legal U.S. resident. You’ll also have to provide your Social Security number and a valid government ID (such as a driver’s license or passport). In some cases, the bank may also require a minimum initial deposit, usually between $25 and $100.

What are the benefits of using a checking account?

The primary benefit of a checking account is the ease at which you can deposit, withdraw, transfer and manage your money. In addition, checking accounts provide several benefits over other ways of saving your money, such as increased flexibility, FDIC insurance of up to $250,000, access to a debit card and the option to have your employer deposit your paycheck directly into your account through direct deposit.

How do I write a check?

Writing a check is straightforward once you understand each step. Think of a check as an official document instructing the bank to pay someone from your account.

Steps to write a check:

- Date: Write today’s date in the top right corner. This indicates when the check was written. You can also postdate the check for future payments, but keep in mind that banks may process it earlier unless notified.

- Payee: On the line labeled "Pay to the Order of," write the name of the person or organization you are paying. Be specific to ensure the bank knows who to pay.

- Amount in Numbers: In the box next to the payee line, write the payment amount in numbers, including cents (e.g., "234.56").

- Amount in Words: Write the payment amount in words on the line below the payee’s name, matching the numerical amount. For cents, write them as a fraction over 100 (e.g., "Two hundred thirty-four dollars and 56/100").

- Memo: Use the "For" or "Memo" line at the bottom left to note the purpose of the check (optional). This can help with record-keeping or tracking payments.

- Signature: Sign your name on the line at the bottom right to authorize the payment. Make sure your signature matches the one on file with your bank. Never sign a blank check to avoid fraud.

Additional Tips:

- Use a blue or black gel pen to make it harder for anyone to alter the check.

- If you need to void a check, write "VOID" across the payee line, amount box, and signature line to prevent misuse.

By following these steps, you ensure your check is properly filled out and can be processed without delays.

How do I cash or deposit a check?

There are several ways to cash or deposit a check. If you have a checking account, the easiest way would be to cash the check either in-person at your local bank branch or online using your bank’s mobile app.

If you want to cash the check in person, go to your local bank and hand over the check and an ID or bank card (such as a debit card) to the teller. The teller can then give you cash for the check or deposit the amount directly into your account.

If you’d prefer to cash the check digitally, most banks offer virtual check cashing options through their mobile apps. If you choose this route, you’ll have to take a picture of the front and back of the check using your phone and upload these photos to your bank through their app.

In either scenario, make sure to endorse the check by signing your name on the back immediately before you hand it over to the teller or upload the image to your mobile app.

If you don’t have a checking account with a bank, there are still several options available for cashing the check. For example, you could take the check to the bank that issued it or cash the check at a local retailer or grocery store.

Note, however, that cashing the check anywhere but at your own bank will likely mean paying a small fee of either a few dollars (usually less than $10) or a percentage of the check’s total amount.

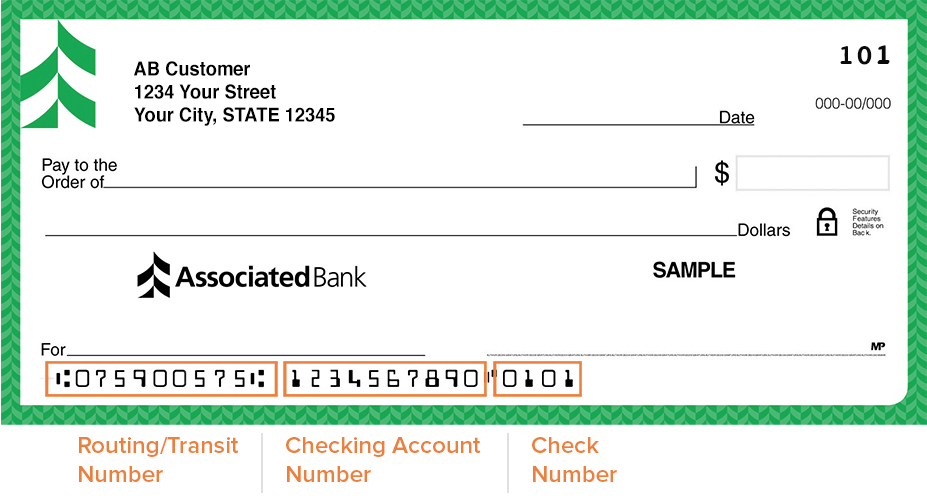

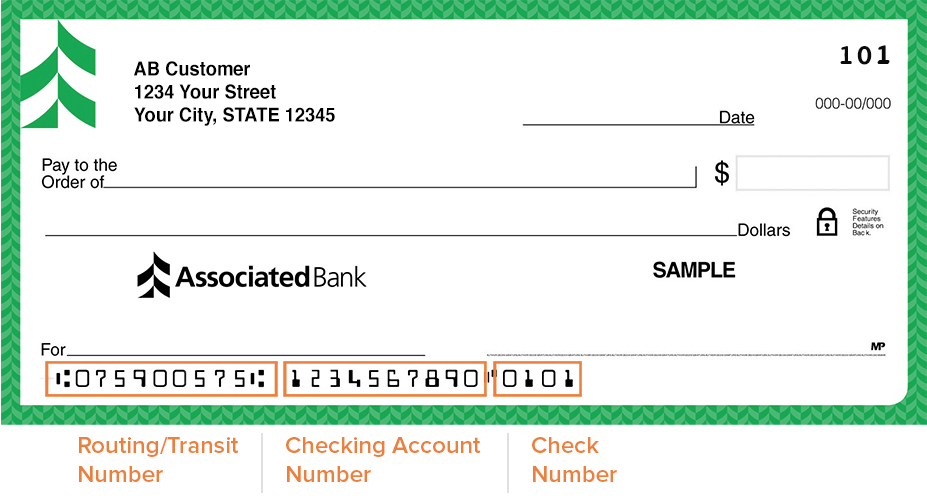

What do all the numbers on a check mean?

Most checks include three numbers that you should be aware of: the routing number, the checking account number and the check number. These are usually written along the bottom left-hand corner of the check:

- Routing number — The routing number is a 9-digit code that identifies the financial institution where your money is being held. Routing numbers are assigned by bank and state. So, all checks issued by your local Associated Bank branch will have the same routing number, no matter who they are issued to. Meanwhile, a larger bank might have different routing numbers for their operations in each state or region.

- Checking account number — The checking account number identifies the checking account that the check is associated with, and the account that the money will come out of. This number is private to you and unique to your bank account.

- Check number — The check number simply identifies the specific check that you’re holding. Generally, checkbooks will have around 100 checks, each with an associated number to identify which check is which.